Kolkata: Making additional provisions beyond the immediate regulatory mandate is becoming a way of life for banks across the spectrum yet again some four years after the pandemic, when Mint Road had required banks to go for pre-emptive cover. The trigger this time, however, is a change in the risk framework on doubtful advances.

Several public sector banks have now decided to frontload provisions as a preparation for the proposed expected credit loss (ECL) framework, while a clutch of private lenders with exposure to the microfinance sector too have set aside additional funds in the second quarter to cover the anticipated stress in their books.

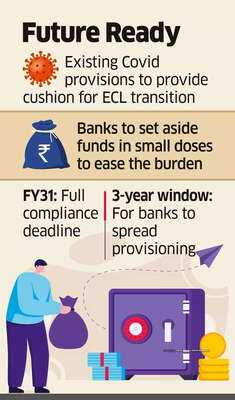

To be sure, the ECL framework involves a stage-gated transition beginning April 2027, and banks have until FY31 to ensure full compliance. Axis Bank, HDFC Bank and ICICI Bank already had sizable contingent and floating provisions which would help them during the transition to the ECL framework from April 2027, analysts tracking the banking sector said.

Axis Bank, HDFC Bank and ICICI Bank already had sizable contingent and floating provisions which would help them during the transition to the ECL framework from April 2027, analysts tracking the banking sector said.

In the public sector space, the likes of Bank of Maharashtra, Indian Bank and Uco Bank have started frontloading provisions from the June quarter or even earlier, while Indian Overseas Bank said it would start doing so from the next quarter.

"We are still assessing the impact of the new framework, but we have started making additional provisions," Indian Bank managing director Binod Kumar told ET.

"We have made provision of SMA 1 (special mention account 1) around ₹400 crore in this quarter. As per the definition, SMA 1 will be stage 2 and in the draft guidelines of ECL, and we need to make 5% provision, so that we have initiated in this quarter, and going forward also we will be maintaining that," he explained.

'One Percentage Point'

Initial estimates done by banks showed that a bank with a size of ₹2.5-2.8 lakh crore loan portfolio would need around ₹2,500-2,800 crore of additional provision at the point of transition to the ECL framework. Banks will have the option to break this into instalments over a three-year period until FY31.

"During Covid, we had made floating provisions. Time has again come to create additional provision buffers in the balance sheet," Indian Overseas Bank managing director Ajay Kumar Srivastava told ET.

"According to a ballpark estimate, around ₹2,700 crore to ₹2,800 crore of additional provision may be required at the time of transition and which are to be provided in installments. From next quarter onwards, we are going to make the additional provision," he said.

Banks having unused Covid provisions lying on their books are planning to utilise this for the ECL purpose.

Uco Bank, for instance has ₹1,000 crore of excess provisions, with ₹530 crore built during Covid and a fresh ₹462 crore set aside for ECL.

On the other side of the spectrum, the Hinduja group-promoted IndusInd Bank under new managing director Rajiv Anand decided to set aside ₹900 crore in the second quarter as accelerated provisions while it wrote off microfinance loans to the tune of ₹1,940-crore to boost its balance sheet, even at the cost of making a ₹437 crore of quarterly loss.

Federal Bank also took a management overlay of about ₹46 crore in the last quarter on some standard accounts even before reclassification as a precaution on retail loans.

Among small finance banks, Jana is carrying a ₹222 crore of accelerated provisions.

"In my head, it's more about the microfinance stress, which has caused us to do the accelerated provision," Jana managing director Ajay Kanwal said at an analyst call.

Several public sector banks have now decided to frontload provisions as a preparation for the proposed expected credit loss (ECL) framework, while a clutch of private lenders with exposure to the microfinance sector too have set aside additional funds in the second quarter to cover the anticipated stress in their books.

To be sure, the ECL framework involves a stage-gated transition beginning April 2027, and banks have until FY31 to ensure full compliance.

In the public sector space, the likes of Bank of Maharashtra, Indian Bank and Uco Bank have started frontloading provisions from the June quarter or even earlier, while Indian Overseas Bank said it would start doing so from the next quarter.

"We are still assessing the impact of the new framework, but we have started making additional provisions," Indian Bank managing director Binod Kumar told ET.

"We have made provision of SMA 1 (special mention account 1) around ₹400 crore in this quarter. As per the definition, SMA 1 will be stage 2 and in the draft guidelines of ECL, and we need to make 5% provision, so that we have initiated in this quarter, and going forward also we will be maintaining that," he explained.

'One Percentage Point'

Initial estimates done by banks showed that a bank with a size of ₹2.5-2.8 lakh crore loan portfolio would need around ₹2,500-2,800 crore of additional provision at the point of transition to the ECL framework. Banks will have the option to break this into instalments over a three-year period until FY31.

"During Covid, we had made floating provisions. Time has again come to create additional provision buffers in the balance sheet," Indian Overseas Bank managing director Ajay Kumar Srivastava told ET.

"According to a ballpark estimate, around ₹2,700 crore to ₹2,800 crore of additional provision may be required at the time of transition and which are to be provided in installments. From next quarter onwards, we are going to make the additional provision," he said.

Banks having unused Covid provisions lying on their books are planning to utilise this for the ECL purpose.

Uco Bank, for instance has ₹1,000 crore of excess provisions, with ₹530 crore built during Covid and a fresh ₹462 crore set aside for ECL.

On the other side of the spectrum, the Hinduja group-promoted IndusInd Bank under new managing director Rajiv Anand decided to set aside ₹900 crore in the second quarter as accelerated provisions while it wrote off microfinance loans to the tune of ₹1,940-crore to boost its balance sheet, even at the cost of making a ₹437 crore of quarterly loss.

Federal Bank also took a management overlay of about ₹46 crore in the last quarter on some standard accounts even before reclassification as a precaution on retail loans.

Among small finance banks, Jana is carrying a ₹222 crore of accelerated provisions.

"In my head, it's more about the microfinance stress, which has caused us to do the accelerated provision," Jana managing director Ajay Kanwal said at an analyst call.

You may also like

Microwave grime wipes off easily thanks to 1 natural ingredient you have at home

A Closer Look at Why Memory Issues Impact More Women Than Men

Badam Puri: Badam Puri tastes like it will make you want to eat it many times, note down the recipe..

India vs Australia: Abhishek Sharma's Solo Demolition Act Proves He's the Best T20I Batter

Bill Gates called it 'burning a billion dollars,' but Microsoft CEO Satya Nadella still invested it anyway. Guess who was right?